By December 2020 about 772900 people lost their job s compared to 510000 the year before. Businesses often receive thousands of invoices each day and processing them all requires time effort and resources.

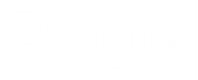

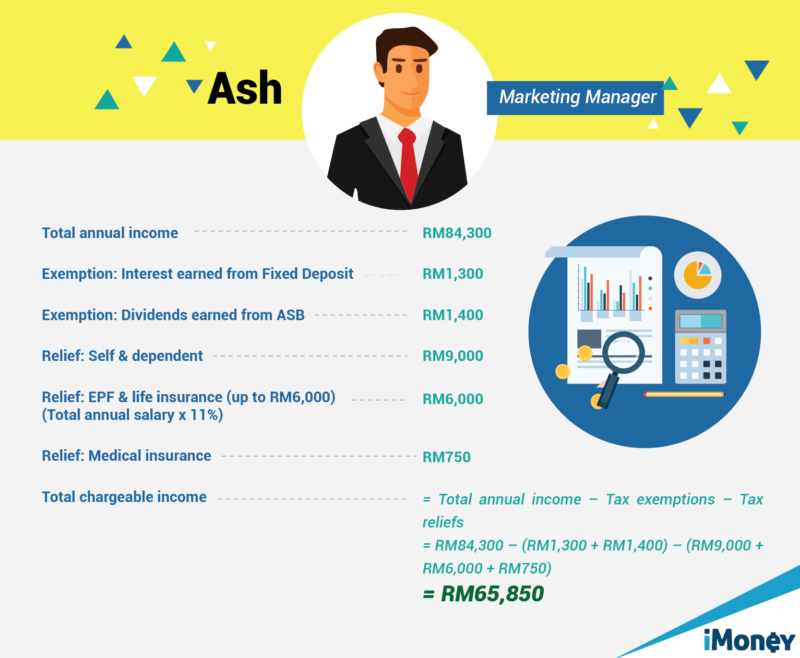

How To Legally Lower Your Taxes

Heres How A Tax Rebate Can Help You Reduce Your Tax Further.

. Calculate Tax Relief for loss on disposal automatically. If you can leverage these schemes your effective payable tax would appear much lower. The NRWT rate on interest is 10 but is reduced to 0 if it is payable to eligible financial institutions.

Some typical tax relief for tax residents in Singapore are. Resignation Vacation or Death of Sole Director or Last Remaining Director. Taper relief reduces the tax payable where there are more than three years between the date of the gift and the date of death.

Allow to key multiple disposers and acquirers and generate related forms automatically. The nation hasnt seen such a high rate of unemployment since 1993. Written by iMoney Editorial.

Calculate payment under 21B of RPGTA. Capital allowance is given to reduce the tax payable for the capital. Last year also ended with the Malaysias unemployment rate rising to 48.

Find Out Which Taxable Income Band You Are In. Calculate Exemption under PU. This will entitle you to a 50 discount on your capital gains tax payable when you sell the property.

The nature of the capital and the purpose of. The NRWT rate on dividends is reduced to 5 if the beneficial owner is a company holding at least 50 of the voting power in the company paying the dividends and 15 in all other cases. Accounts payable automation software helps organizations pay for invoices in an organized timely manner for the precise amounts.

If the donor dies within seven years an IHT charge will arise and tax will be payable by the donee. This will be recorded by crediting increasing a deferred tax liability in the statement of financial position and debiting increasing the income tax expense in the statement of profit or loss. Monthly tax deductions in Malaysia are governed by the STD mechanism - which reduces the need for employees to pay tax in one lump sum.

These Are The Personal Tax Reliefs You Can Claim In Malaysia. Capital Allowance is used as a subsidy to for the depreciation of fixed assets. Capital gains tax can be payable on valuable items or assets sold at a profit.

Aside from having one of the lowest tax rates in the world Singapore also offers a wide array of favorable tax incentives and tax reliefs. Income Tax 101 with our easy to use calculator and tax guides. Assuming that the tax rate applicable to the company is 25 the deferred tax liability that will be recognised at the end of year 1 is 25 x 300 75.

2020 was a year that most of us had never experienced before with the impact of the Covid-19. Get the most out of Malaysias banks and finance companies when you save invest insure buy and borrow. Currently an overseas company with no permanent establishment in Malaysia would not be liable to register for Sales Tax or Service Tax.

How to Reduce Personal Tax Income in Singapore. Calculate allowable loss automatically. Capital allowance is only applicable for businesses and not individuals.

In addition the tax credit is not limited to 25 of the donating companys gross tax payable less the deductions for international double taxation and tax relief for income obtained in Ceuta and Melilla for export activities and for local public services which is applicable for other tax credits see CIT relief in the Tax credits and. Get more out of your accounts payable process with automation. For the purpose of appointing a new director in the event of the office of a sole director or the last remaining director of the company being vacated the secretary shall as soon as practicable call a meeting of the next of kin other personal representatives or a meeting of members as the case may be.

Understand the pros and cons for each card and discover the features. Learn the Basics. Further details regarding the tax due on PETs at the time of a donors death are given later in this article.

However from 1 January 2020 foreign service providers of digital services to consumers in Malaysia exceeding MYR500000 per year will be liable to register for Service Tax. If you make the decision not to sell the PPOR residence after six years of renting it out the market value rule will be applicable to help potentially reduce your capital gains. All employees in Malaysia should be issued with a payslip when they are paid including information such as wages earned and deductions made.

Malaysia used to have a capital gains tax on real estate but the tax. A Latvian company can reduce the tax base by the capital gains the company has earned from the sale of shares if the Latvian company has held those shares for at least 36 months. How Does Monthly Tax Deduction Work In Malaysia.

Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. Supplementary dividend tax credit regime. Credit Card Reviews Reviews for the top credit cards in Malaysia.

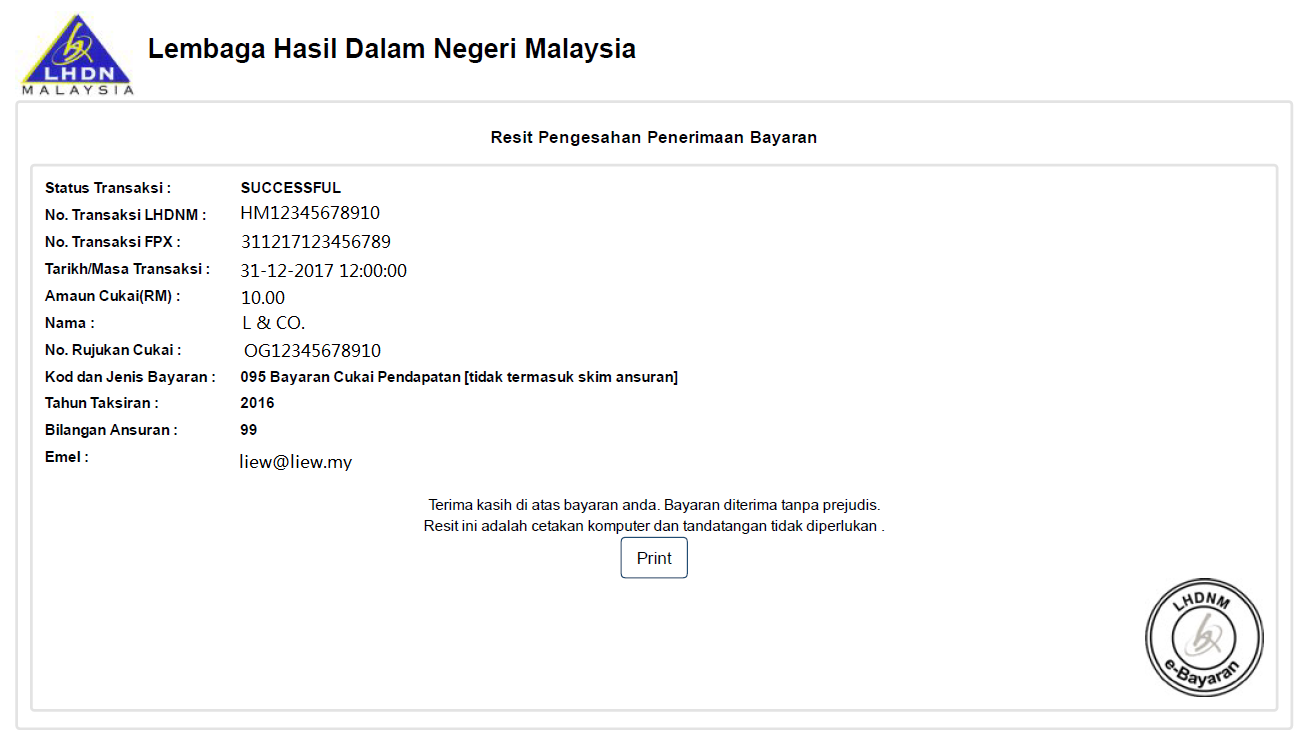

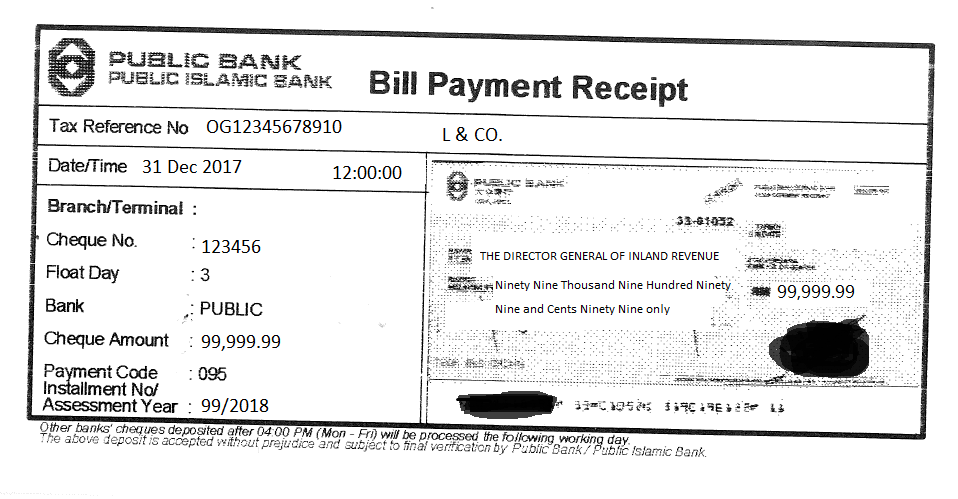

Compute tax payable automatically.

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Tax And Investments In Malaysia Crowe Malaysia Plt

Tax On Rental Income 5 Rules You Must Know If You Rent Out Property In Malaysia

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Cukai Pendapatan How To File Income Tax In Malaysia

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

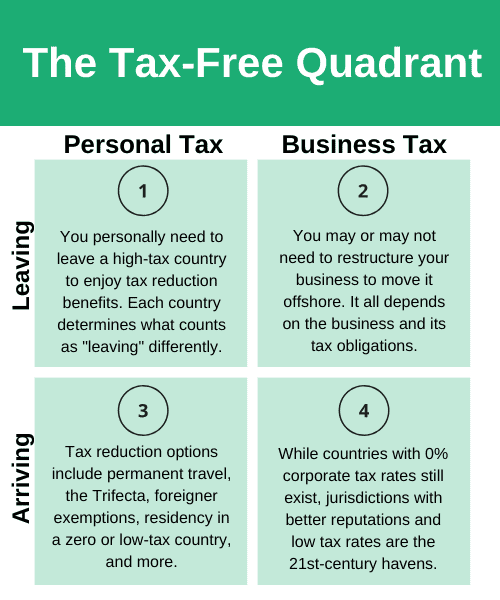

Tips For Income Tax Saving L Co Chartered Accountants

Tax Rebate For Set Up Of New Businesses L Co

Tips For Income Tax Saving L Co Chartered Accountants

Malaysian Tax Issues For Expats Activpayroll

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Malaysia Payroll What Is Pcb Mtd

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Tips For Income Tax Saving L Co Chartered Accountants

Tips For Income Tax Saving L Co Chartered Accountants

Updated Guide On Donations And Gifts Tax Deductions

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia